Should You Sell Your Home in Retirement?

Home ownership accounts for nearly half of middle-class household wealth. We outline reasons for and against selling this asset in retirement.

A home is often the biggest and most expensive asset someone owns. It’s also likely the place where people have raised a family and experienced important events. But as homeowners near retirement, a big question mark looms over their prized possession. That is, is it better to hold on to your house as an asset or sell it?

Ultimately, many reasons on both sides may influence the decision to buy or sell. For instance, selling may allow one to supplement their retirement income, while retaining it may be better for those who want to pass it down.

In this study, we’ll explain why home ownership is a substantial component in people’s lives and, consequently, their retirement plans. We’ll also outline reasons for and against selling a home ahead or during your post-working years. Finally, we’ll highlight why it’s critical to seek out financial advice when deciding whether to keep or sell your home.

Key Takeaways

- A home often makes up for a large portion of someone’s overall net worth, especially for households with fewer assets.

- Selling a home can be beneficial because of the cash lump sum and the need to downsize, among other reasons.

- Keeping your home can allow you to maintain a connection to an emotional part of your life and retain ownership of a valuable asset.

- A financial advisor can offer insight into which path makes the most sense to you, as well as how to navigate it.

Financial Significance of Home Ownership

Because of their high value, a home is typically a large part of anyone’s financial portfolio and, therefore, net worth. According to a survey we conducted of just over 32,000 respondents aged from below 30 to 60-plus, the following are the percentages of people in each age group who said they own a home:

| Age | Percentage of Home Ownership |

|---|---|

| Below 30s | 17.63% |

| 30s | 23.71% |

| 40s | 16.55% |

| 50s | 16.74% |

| 60s and over | 25.37% |

As the chart illustrates, the percentage of those in our survey who own a home across all ages is quite similar, ranging from young adulthood to old age. The largest group of homeowners in our survey, however, are those aged 60 and over at around 25%. These are people entering or who have already begun their retirement.

How a home factors into someone’s retirement plan can depend on myriad circumstances. An important one, however, is how much of their net worth it accounts for. As noted, a house often represents a large chunk of a person or couple’s worth. However, the U.S. Department of Health and Human Services’ Health and Retirement Study (HRS) shows that this is especially the case for individuals who have fewer assets. Specifically, a chart within the study illustrates that married households of people aged 55 to over 85 had a higher amount of their worth in their home if they had smaller net worth. Conversely, for married couples with higher portfolio value, while a large proportion still represented their home ownership, a greater amount of their worth included other securities such as IRAs, stocks, and bonds.

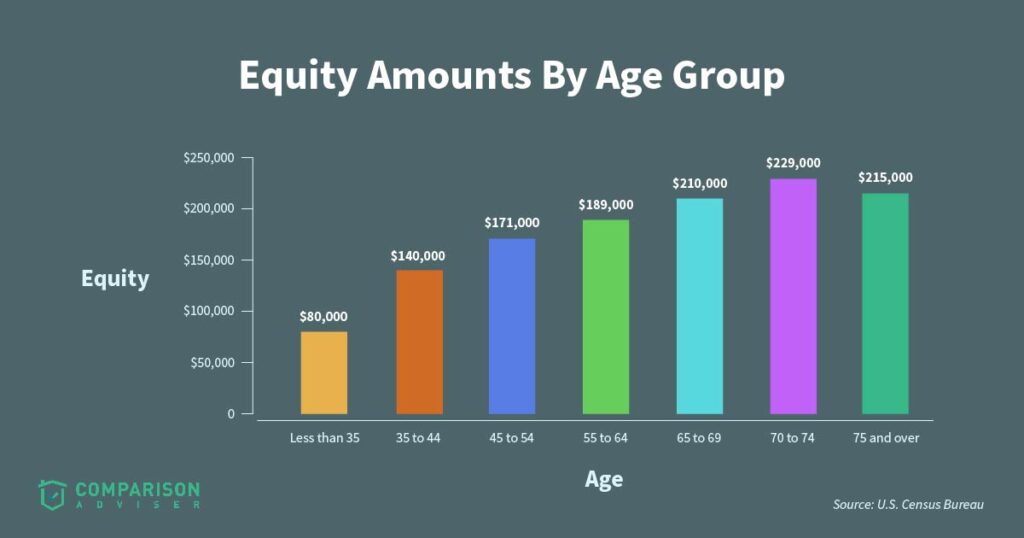

The weight a home can have on someone’s net worth can also vary by age. Per data from the U.S. Census Bureau’s Survey of Income and Program Participation on wealth and asset ownership, the following displays how much equity, on average, people have in their homes as they age:

The graph above exhibits that houses become much more valuable in one’s portfolio as people enter retirement age, likely representing more of their net worth. This could be either because people own more valuable houses as they’ve made more money in their careers or have gained more equity by making mortgage payments. Because home equity is usually a bigger segment of someone’s net worth in old age, it can be an important part of a retirement plan, either as a retained asset or a target for liquidation.

Reasons to Sell a Home in Retirement

Someone may choose to part with their family home in retirement for various reasons. Some aspects may include financial implications, such as taxes or the windfall it could yield. Others, though, are more practical, including the potential need for less space or property to maintain as you age.

Sizeable Cash Infusion

One of the most notable benefits of selling a home in preparation for retirement is the large cash infusion that it can yield. There will likely be things you want to accomplish or places you want to travel or live. For example, Chris Urban, CFP, RICP, founder at Discovery Wealth Planning, says that “perhaps you want to travel and/or move to a different part of the country or internationally even.” If this is the case, he suggests considering the costs associated with relocating to or visiting other locales, which can be lofty.

If you sell your home, you could bolster any funds you’ve already saved up or start your retirement with a decent nest egg you previously didn’t have. This can give you more options for how you would like to live after you stop working. So, if you want to move elsewhere or tackle new opportunities, selling your home might set you up to do so.

Additionally, beyond the fun parts of no longer working, the money you receive from the sale may help you handle expensive and unfortunately common unforeseen medical care needs. In other words, selling your home for a large sum and downsizing your living arrangement can enable you to build an emergency fund to prepare for these situations.

May Set Up Other Retirement Plans or Investments

The money from selling your home, especially if for a substantial amount, may allow you to proceed with additional retirement plans or select other investments more suited to your new stage of life. As mentioned above, relocation is a common strategy; however, some retirees may also take the opportunity to use their newfound funds to restructure their portfolios or put together an effective estate plan.

Downsizing

A practical and prevalent reason to sell your home around the time you retire is downsizing. “You may choose to downsize if you no longer need as much space and/or do not want the burden of owning a home,” says Urban.

As you age and children move out, you may feel that you don’t need to have as big a house as you once did. Beyond that, as Urban suggests, owning a home comes with a lot of responsibility that could affect your well-being. If it’s a big house, you’ll need to undertake a lot of the maintenance and upkeep. At first, this may seem like no problem, but it may become more difficult as time goes on.

If you choose to sell, you could move to a smaller, less time-intensive home more suitable to your needs. This could be a condo or apartment, which are turn-key and come with minimal maintenance, or a smaller house with less to take care of.

For some people, it’s important to highlight that downsizing doesn’t always mean moving into a less expensive home. It can sometimes just mean transitioning to a smaller home with less upkeep, but it may also be at a similar cost as the home you just sold. This can especially be the case for homes in cities with an expensive cost of living or in desirable locations.

Moving Closer to Family

Moving closer to family members, such as children or grandchildren, is another valid cause to put your house on the market. As you’re moving into a new chapter, so too will your family. Relocating to a house near them can be a way to make your life feel as full as it once did when everyone was under the same roof. It also allows you to be there for your family, and them to be there for you.

Costs Associated With Owning a Home

Alongside the maintenance tasks that come with being a homeowner, there are also a significant amount of costs that could eat into your retirement funds. Common expenses may include property taxes, home insurance, and simply the bills that go along with keeping the house functional; however, you may also incur costs from maintenance and general housekeeping. If you sell, you may be able to avoid these or, at the very least, lessen them and move into a new house that fits your new chapter.

Reasons Against Selling in Retirement

While there are several reasons to sell a house upon retiring, there are many counterpoints to doing so. The decision to retain your house in retirement may include both financial factors, as well as emotional and practical ones.

Emotional Attachment

Buying a home isn’t one of those decisions in life that people take lightly. It usually involves a generous down payment and a leap of faith that you could see yourself living there for a long time.

Assuming you purchased when you were much younger and haven’t moved, it’s likely you’ve gone through many important, sentimental points of your life in your house. You might have raised children, held holiday parties, and more. And even if you didn’t do these things, it’s hard not to build somewhat of a bond with a home you’ve lived and invested in for years.

While it’s not uncommon for people nearing retirement to talk of downsizing and shifting gears, Urban points out that “[s]ome people want to age in place and live forever in the home that, perhaps, they have lived in for years.” He continues, “If you have more than enough money to meet all of your goals in retirement and you just want to age in place then I would certainly lean more towards just remaining in the home where you are most comfortable.”

Huge Undertaking

Another reason to reconsider selling your house ahead of retirement is that it can be a huge undertaking. That is, you’ll need to go through the sale process and get your house ready and presentable to sell. This is not always easy, nor is it always cheap. For example, you may need to upgrade your house to make it more desirable or you may need to pay an agent.

Once you do sell your house, you’ll also face the task of packing up all your belongings and transporting them somewhere else. Even with help from a moving company, consider that you’ll need to deal with your stuff once it’s in your new home.

Financial Stability

A subsequent reason to hang onto your home is because it might afford you some financial stability. While, as mentioned in an earlier section, selling your home can afford you a decent lump sum of money, retaining ownership means you get to keep your valuable asset. This has many advantages, including:

- The opportunity to rent out. As a homeowner, you could choose to rent out your home and collect payments in retirement, creating a continuous stream of income.

- Inflation protection. Keith Spencer, CFP, founder of Spencer Financial Planning, says that “real estate tends to offer excellent protection from the effects of inflation. If inflation in the economy takes off, the value of your real estate is likely to keep pace.”

- Avoiding rent. If you have a favorable mortgage, this may be better than paying expensive rent prices. Per Spencer, this can be “much better” for your “budget” in retirement.

Estate Planning Purposes

Finally, you might want to hang onto your property to include it as part of your estate plan. Because it’s a considerable asset in your portfolio, you may decide to live in it for the rest of your life and include it in a trust, will, or other document to eventually pass down to your children, grandchildren, or other family member.

When you pass it down, your relatives will be in a position to reap the potentially higher monetary value of your home. Or, in other cases, they may simply choose to live in it, keeping its sentimental value alive in your family.

Importance of Retirement and Estate Planning

Choosing whether to sell your home for retirement is a personal decision. There are many benefits and potential pitfalls on both sides, and it will be up to you to choose what works best. However, because making a change like this has such a major impact on your finances and future, it’s good to consult with a financial planner skilled in working with retirees or those nearing it before proceeding down a path.

It’s important to note that, while selling a home commonly coincides with retirement, market conditions may shift, meaning that there may be occasions when selling a home or buying may not be as ideal. A financial advisor may be able to help you understand the current and projected future state of the markets, which can help you feel more confident about your plan.

Ultimately, an advisor will be able to help you understand how either selling or keeping your home fits into your holistic financial plan. For instance, if you sell your home, they can assist you with managing the sale funds and mapping out your next move, including helping you understand how to put together an emergency fund and how you can afford your next residence. On the other hand, if you keep your home, a professional could help with anything from estate planning to maximizing income from it.

Methodology

A portion of the data referenced in this article is based on an anonymized survey conducted by Datalign Advisory, LLC, a partner of ComparisonAdviser. Respondents are prospective clients searching for financial advisor firms in their area. In the survey, participants were asked questions regarding their age and whether they currently own a home.