How Age and Time Horizon Impact Investor Decisions

Many factors influence the decisions investors make. This study examines how age and time horizon affect reactions after a sharp market drop.

How would you handle a sudden and significant market drop? Sometimes leading to jarring losses, such an event may force you to question how comfortable you are with the financial plan you have in place. You may wonder if you should hang tight and wait for markets to recover, consider shifting your strategy, or, perhaps more drastically, cut your losses.

There are several factors at play, however, that may dictate how much risk you could tolerate after a market decline. Age and, consequently, time horizon are two of the most important. In this study, we’ll explore how these two aspects can directly impact risk tolerance by analyzing what percentages of people in different age groups say they would do during a substantial market drop.

Key Takeaways

- According to our survey, approximately 30% of respondents across all age groups would hold during a market drop of 25%.

- As people near retirement, they say they’re less likely to invest or shift their strategy.

- Younger people, especially those under 30 years old, claim they would take more chances by investing or shifting their plans.

What Is Time Horizon?

In investing and financial planning, time horizon is how long it takes to accomplish a particular goal. For instance, if you have decided that you want to retire at 65 years old and you’re currently 35, then your horizon to reach this benchmark is 30 years. Some milestones, like retirement, can be more transitional, however, leading you into a period with different needs and investment aspirations.

Often, financial advisors use time horizon as a measuring stick when helping you create a plan to reach your goals. When managing your portfolio, for example, an expert may look at your age and goal to discern a time span or use a specific window you have provided to decide which types of assets to invest in.

“Retirement tends to be the most important factor in planning an investment horizon,” says Asher Rogovy, chief investment officer of New York-based investment advisor firm, Magnifina. “Other milestones might include saving for a [down payment] or building an educational fund,” he continues.

What People Would Do During a Market Drop

Variables such as age, time horizon, risk tolerance, and types of goals can directly influence the actions someone may take after a market drop. To demonstrate the varying reactions, we surveyed over 32,000 respondents of various age groups to see what people would do in a hypothetical scenario where the market dropped about 25%. People could select whether to hold their investments, invest, shift their strategy to something more conservative, or say they were unsure.

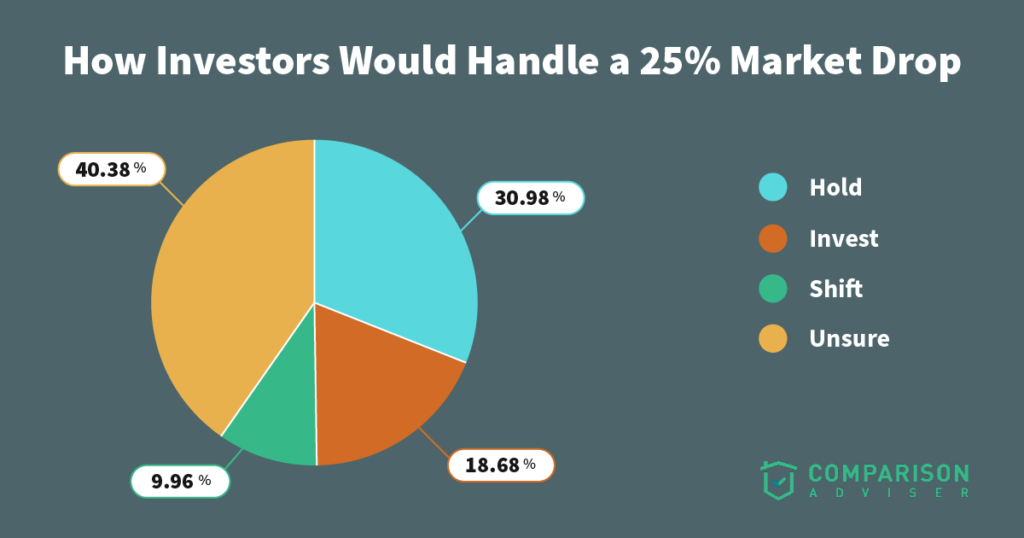

The following pie chart breaks down the results across all age groups in the study:

Though most people in the study say they’re unsure what they would do if the market declined by 25%, the data above shows that, of those sure, a large set of almost 31% would keep their plan in place and hold their positions. Alternatively, about 18% of participants say they would take advantage of the slump in prices and invest in new securities, and a smaller group of nearly 10% say they would shift gears.

It’s important to note, however, that what one says they would do during a downturn and what they would actually do are two separate things. Per a study by Rowan University, it’s not uncommon for investors to overreact following stock market crashes. When bubbles burst and bear markets — stock market drops of over 20% — occur, individuals may lose confidence in their plans and make decisions out of emotion or impulse.

How Age Affects Decisions

Based on our data, age can affect how people say they’ll react to a market downturn. It can be both a direct factor in someone’s overall time horizon to common goals such as retirement and, therefore, a driving cause in the level of risk an investor may be able or willing to bear. For example, someone at a younger age may have a larger time horizon and may be more able to invest more aggressively than someone older who’s close to reaching the goal they’ve worked hard to achieve.

Below is a more specific breakdown of how age affects people’s reactions to a 25% market drop:

Below 30s

This data displays percentages of all respondents below the age of 30 and their perceived decision following a market crash:

| Decision | Percentage |

|---|---|

| Hold | 21.97% |

| Invest | 23.17% |

| Shift | 10.48% |

| Unsure | 44.38% |

In the above results, most say they’re unsure of what they would do; however, a large, combined number say they would either hold or invest. A potential reason is that investors in their 20s have far longer investment horizons than others further along in life, such as those in their 40s to 60s.

Because younger people have more years until retirement and may take on fewer costly liabilities, such as owning a home, they might feel more comfortable holding onto investments that have just taken sharp losses or adding them to their portfolio, hoping that they rebound and grow over time.

“In a perfect world, an investor who does not need to access their capital in a relatively short time frame should feel confident taking on more risk,” Jake Falcon, CRPC, CEO of Falcon Wealth Advisors points out. “Generally speaking we don’t typically like to see investors buy stocks with cash that they foresee needing within the next five years. By allowing time for stocks to fluctuate up and down, an investor could benefit from the risk premium that is inherent with owning equities,” he adds.

30s

The following comprises all respondents in their 30s and their perceived decision following a market decline:

| Decision | Percentage |

|---|---|

| Hold | 26.76% |

| Invest | 23.58% |

| Shift | 8.30% |

| Unsure | 41.35% |

The data above follows a similar pattern to the actions those in their 20s believe they would make. Over half of participants in their 30s say they would either maintain their current holdings or continue investing. Like their younger counterparts, investors in this age range often have more time until they reach milestones like retirement, giving them more freedom in how they can invest. They may also feel confident in their plan and have faith that their investments can recover their value.

40s

This table displays percentages of all respondents in their 40s and their perceived decision following a downturn:

| Decision | Percentage |

|---|---|

| Hold | 30.63% |

| Invest | 22.19% |

| Shift | 7.52% |

| Unsure | 39.66% |

Respondents in their 40s answered differently than those in the previous two age groups. Specifically, a much larger percentage of them said they would hold their investments in place, while the number who said they would invest remained about the same. People in their 40s may have spent more time building a portfolio and might aim to avoid overreacting to a sudden drop by holding.

50s

This data illustrates percentages of all respondents in their 50s and their perceived decision following a market drop:

| Decision | Percentage |

|---|---|

| Hold | 35.39% |

| Invest | 17.48% |

| Shift | 9.10% |

| Unsure | 38.05% |

Like those in their 40s, survey participants in their 50s increasingly say they would hold their plan in place. Conversely, the number of those in this cohort who say they would use a dip to invest more is about 5% lower than it is for the other three ages. The reason? As investors get older, they may have already shifted to a more conservative strategy or, potentially, don’t want to sell the positions they may have held for years at a loss.

60s and Over

This data exhibits percentages of all respondents at least 60 years old and their perceived decision following a market crash:

| Decision | Percentage |

|---|---|

| Hold | 38.48% |

| Invest | 9.48% |

| Shift | 13.33% |

| Unsure | 38.71% |

In the above table, a significant 38% of people 60 and older say they would hold their investments in place. Unlike the other age groups in this study, these respondents are either closer to retirement age or have already entered their post-working life. At this point, their risk tolerances and time horizons are lower and shorter, respectively. Therefore, to not risk the possibility of accomplishing their goals, incorporating safer strategies, such as holding, can give them reduced exposure to losses or volatility.

How Time to Retirement Affects Decisions

Just as age is an important deciding element in what one will do in the wake of a market drop, time horizon is also critical. To illustrate this, we analyzed people’s distance until they reach retirement and examined how this impacts their strategic decisions.

The table below displays what percentages of our survey respondents of varying time to retirement (TTR) would do:

| TTR (Years) | Hold | Invest | Shift | Unsure |

|---|---|---|---|---|

| 11+ | 15.86% | 12.93% | 4.75% | 24.55% |

| 6 to 10 | 3.64% | 2.14% | 0.95% | 3.90% |

| 2 to 5 | 3.22% | 1.24% | 1.00% | 2.81% |

| Less than 2 | 2.70% | 0.81% | 0.90% | 2.48% |

| Already retired | 5.56% | 1.57% | 2.38% | 6.65% |

According to the data above, most people would hold during a market drop, regardless of their time horizon. However, of those who would invest or shift, individuals who are closer to retirement are less likely to choose either option. This may be due to them feeling the need to preserve the progress they’ve already made or to avoid making any hasty decisions.

It’s also possible that those closer to retirement age may have a more conservative asset allocation. This is because most investment strategies are specifically tailored to one’s goals, risk tolerance, and time horizon. If one is approaching their goal — in this case, retirement — they or their advisor have likely rebalanced their portfolio to match their situation.

Key Findings

Though what one may do in the event of a market crash is surely up to interpretation, there are components that may sway someone’s decision one way or the other. In our study, we aimed to understand whether someone’s age and time horizon might impact what they would do if a drastic market drop occurred. Based on our results, this appears to be the case.

The data revealed that those in younger age brackets with longer time horizons were more likely to take advantage of all the opportunities on the table, including holding their positions for the long term, investing in new securities, and shifting their plan. On the other hand, older investors in their 40s to 60s were less likely to put their portfolios in jeopardy. Instead, they were more inclined to hold on to their investments or shift to a more secure plan.

Ultimately, an investor’s perceived behavior following a slump falls upon their risk tolerance, a result of their age and time horizon. Per our study, younger people with goals far ahead of them may feel comfortable taking on more aggressive strategies, while those nearing their milestones, generally in older age groups, tend to be more conservative.

Methodology

The data used in this article is based on an anonymized survey conducted by Datalign Advisory, LLC, a partner of ComparisonAdviser. There were approximately 32,000 respondents, all of whom were prospective clients searching for a financial advisor. In the survey, participants were asked questions regarding their age, distance from retirement, and what they would do following a theoretical market drop of 25% in one month.