What Is a Bond Ladder?

Bond laddering involves staggering maturity dates of fixed-income assets. Learn how it works and the benefits here.

Bonds and other fixed-income securities often find their way into investment portfolios because of their uniqueness from other assets and their low risk and relative stability. While there are many ways that they can take shape in an investor’s strategies and plans, one method of investing in bonds is laddering, which involves investing in various bonds that mature at different rates.

In this article, we’ll highlight the basics of bond ladders and explain how they work. Additionally, we’ll offer an overview of what type of investor they’re often helpful for, their pros and cons, and what it generally takes to build one, especially with the help of a financial advisor.

Key Takeaways

- Ladders are portfolios of fixed-income assets such as bonds or CDs with staggered maturities.

- Bond ladders can provide regular income at favorable interest rates, allowing for reinvestment of gains over time as securities mature.

- Due to their predictability and relatively low risk, ladders can be helpful for risk-averse or conservative investors, such as retirees or those wanting to preserve capital.

- A financial advisor with knowledge of investing in fixed-income assets can be a helpful resource if you want to build a bond ladder or learn more.

How Bond Ladders Work

A bond ladder is a specialized portfolio of bonds with staggered maturity dates. The idea is that each fixed-income security matures at different times. According to Jake Falcon, CRPC, CEO at Falcon Wealth Advisors, this is usually “at regular intervals, such as every year or every few years,” much like the evenly spaced rungs on a ladder.

The primary advantage of establishing a ladder for bonds or other fixed-income securities like certificates of deposit (CDs) is two-fold—it allows you to receive regular income and lock in interest rates over a specific duration without needing to time the market. Specifically, per Falcon, it “helps manage interest-rate risk and provides a steady stream of liquidity as bonds mature and are reinvested.”

When your bonds mature, you’ll collect interest payments with your principal, enabling you to reinvest the funds. Depending on your goals and risk tolerance, this could be back into more bonds, CDs, or other assets such as equities. “A bond ladder can help you stay disciplined to reinvest the funds in order to ride out interest rate fluctuations,” explains Steve Azoury, ChFC®, owner of Azoury Financial in Troy, Michigan.

Who Needs a Bond Ladder?

In general, fixed-income securities are seen as carrying lower risk than other asset classes such as equities, commodities, and alternatives. They also perform in different ways and are subject to different external factors, making them a common tool for portfolio diversification.

A bond ladder can help individuals limit risk and maintain stability and consistency in their investing strategy. This is because “it provides a predictable income stream, reduces exposure to interest-rate fluctuations, and helps manage reinvestment risk,” says Falcon.

So, who would benefit most from using a bond ladder? According to Falcon, it’s “particularly suitable for conservative investors, retirees, or those seeking a steady income without taking on too much risk.” In other words, these would be individuals who prefer to mitigate risk, as well as those who would like to put a structure in place for steady income at a defined interest rate.

Pros and Cons of Bond Ladders

As noted, bond ladders can be beneficial because they can help you manage risk, achieve diversification, and receive a stable income with the opportunity to reinvest. Additionally, as you spread out “maturity dates” of your bonds and fixed-income assets, “you would avoid getting locked into a single interest rate,” explains Azoury.

However, ladders aren’t without their risks and disadvantages, like any investment or asset allocation. “They can be less flexible than other investment strategies, and the initial setup may require a significant amount of capital,” Falcon says. “Additionally, if interest rates rise, the bonds in the ladder may underperform compared to newly issued bonds with higher yields.”

Below is an overview of the notable pros and cons of bond ladders:

Pros

- Predictable and steady cash flow.

- They allow reinvestment of funds as staggered bonds mature.

- They let you lock in favorable interest rates and avoid timing the market.

- They’re a way to add diversification of fixed-income securities in a portfolio.

Cons

- Limited liquidity of funds before bonds mature.

- Possible opportunity cost if interest rates are high when bonds mature.

- It may require a significant upfront investment in multiple bonds to build the ladder effectively.

- Setting one up may be complex for the average or novice investor.

How to Build a Bond Ladder

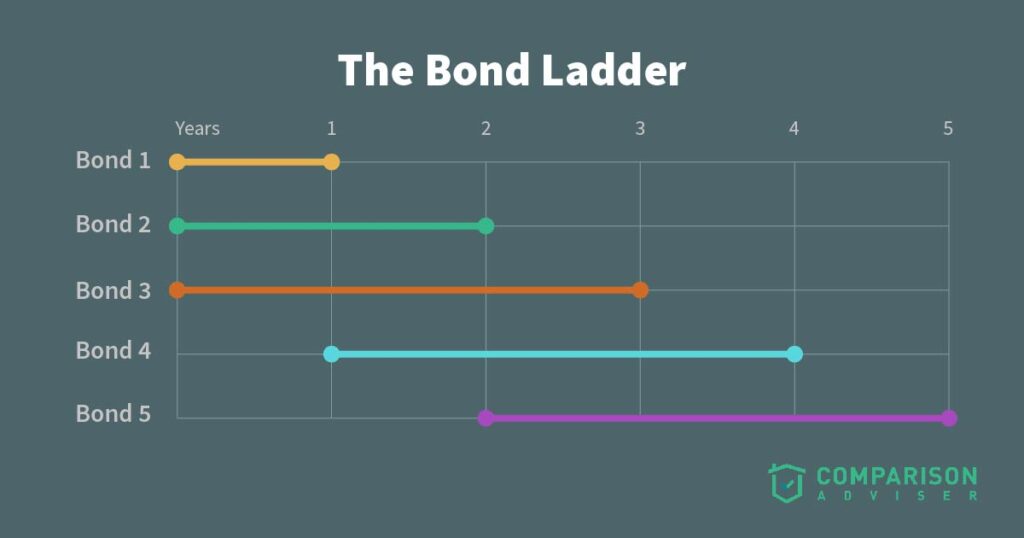

Generally, as mentioned, constructing a bond ladder requires you to purchase several bonds with unique and escalating maturity dates. In this way, the portfolio would resemble a ladder, with each bond maturity being a rung.

Below is a generalized illustration of what this may look like:

Here is a breakdown of the three main elements that make up a bond ladder:

- Rungs. This is the number of bonds and varying maturity dates in the ladder. For example, a 10-year bond ladder with annual maturities would have 10 rungs.

- Space in-between. The spacing between maturities of bonds in the ladder. Normally, this is a fixed period, such as one or more years. This lets you see how long bonds last before they pay out funds.

- Materials. These are the securities that make up your ladder, whether they’re U.S. Treasuries, municipal bonds, corporate bonds, or CDs.

It’s important to note that setting up a bond ladder effectively can be complex. It will require you to research and understand bonds, interest rates, and outcomes, along with how they fit into your larger portfolio and align with your time horizon, risk tolerance, and liquidity needs. Therefore, it’s a good idea to seek the assistance of a financial advisor as you work out how to add them to your overarching plans.

“A wealth advisor can assist with creating a bond ladder by selecting appropriate bonds, managing the reinvestment process, and ensuring that the ladder aligns with the client’s overall financial goals,” explains Falcon. “Advisors can also provide ongoing monitoring and adjustments to the ladder as needed to optimize performance and manage risks.”

If you would like to find a financial professional to help with designing a bond ladder or other investing goals, you can use this free matching tool. After answering a short list of questions about your investing profile, objectives, and circumstances, it will connect you to a reputable fiduciary advisor.

Frequently Asked Questions

What types of bonds are in a ladder?

A ladder could include any combination of bonds or CDs that fit your risk tolerance and needs for liquidity, including:

- U.S. Treasuries

- Municipal bonds

- Corporate bonds

What is the biggest downside of a bond ladder?

One of the most notable disadvantages, according to Azoury, is opportunity cost. “If future rates are lower, then a bond ladder could cost you money by investing at a lower rate,” he says. So, if you invest money in a ladder at a certain interest rate, you could lose the money you would have otherwise gotten from newly issued bonds if rates increase.

Conversely, however, you can also enjoy favorable interest if rates have fallen since you locked in your ladder. Ultimately, it’ll be up to you and your financial advisor to carefully weigh the costs and potential benefits for your situation and portfolio.

How much money do you need to start a bond ladder?

Under ideal conditions, you would need to start with a sizable investment before establishing a bond ladder. When you create one, you must purchase multiple bonds at the same time. Since bonds are typically available for minimums of $1,000 to $5,000, this means that you must be willing and able to put a significant sum of money at once, such as $10,000 to $100,000.