The Great Wealth Transfer: Why to Start Planning Now

The Great Wealth Transfer is poised to bring over $70 trillion to younger generations. Here’s why it’s crucial to start planning for it now.

In the next 20 to 30 years, society is poised to experience the largest generational transfer of wealth in history. Specifically, trillions of dollars will be passed down from the baby boomer generation to Gen X, millennials, and Gen Z. Many currently refer to this ongoing event as the “Great Wealth Transfer.”

While the prospect of wealth flowing down to younger generations may sound exciting, the transfer brings about unique challenges. For older individuals preparing to hand down their fortune, there are plenty of tasks to accomplish to ensure a smooth transition. In the case of heirs, receiving a significant windfall, while often life-changing, can be difficult and stressful to manage. Both of these issues make financial advice a necessity now more than ever.

In this study, we’ll examine what the Great Wealth Transfer is and who stands to benefit most from this event. This includes analyzing data relating to each generation and what they may receive. And, perhaps most importantly, we’ll explain why it’s crucial to begin planning for this event now, whether you’re the one transferring wealth or a beneficiary expecting to receive it.

Key Takeaways

- Over the next 20 to 30 years, approximately $77.6 trillion will pass from baby boomers to subsequent generations.

- Those with parents who are financially well-off or have sufficiently saved for retirement will likely benefit most from the Great Wealth Transfer.

- While a large group of people may be impacted positively by the event, many won’t see any benefit due to a lack of planning or there being nothing to pass along.

- Without an estate plan, wealth transfers become much more difficult and sometimes sow discontent and strife among families.

- Financial advice, now more than ever, is crucial to ensure both families and their heirs see a seamless transfer of wealth.

What Is the Great Wealth Transfer?

The Great Wealth Transfer refers to the current and imminent passing down of generational wealth over the next 20 years. Marguerita M. Cheng, CFP, CRPC, CSRIC, RICP, and expert contributor for Annuity.org, explains that “baby boomers are expected to pass down [trillions] to Gen X (1965 to 1980) and Gen Y (1980s to 1990s) and their children.” As mentioned, this event will take decades, making it more of a trickle than a sudden shift in the context of the entire economy.

This event is significant because it may present new challenges for baby boomers, their heirs, and potentially the economy. Lack of planning and mismanagement of one’s retirement could greatly diminish what one may bequeath to an heir. In the case of beneficiaries, not seeking financial advice or poor handling of their windfall can cause one to squander or not get the most value out of it.

Assets By Generation

One must look at the numbers to comprehend the scale and complexity of the Great Wealth Transfer. Of the approximately $77.6 trillion that’s part of it, one can expect more than just cash to be passed down. No matter the generation, a wide variety of asset classes will transfer to beneficiaries, including:

- Real estate

- Consumer goods

- Shares in mutual funds and equities

- Retirement plans, e.g., pension plans and deferred compensation

- Stake in private businesses

- Alternatives, such as collectibles or shares of hedge funds

Currently, the volume of wealth held by the baby boomer generation towers far above any other, including Gen X, which has some individuals reaching their 60s. To give you an idea of where each generation stands before the Great Transfer, we outline how the total amount of wealth and the types of assets break down for each generation (see methodology for information on the data source):

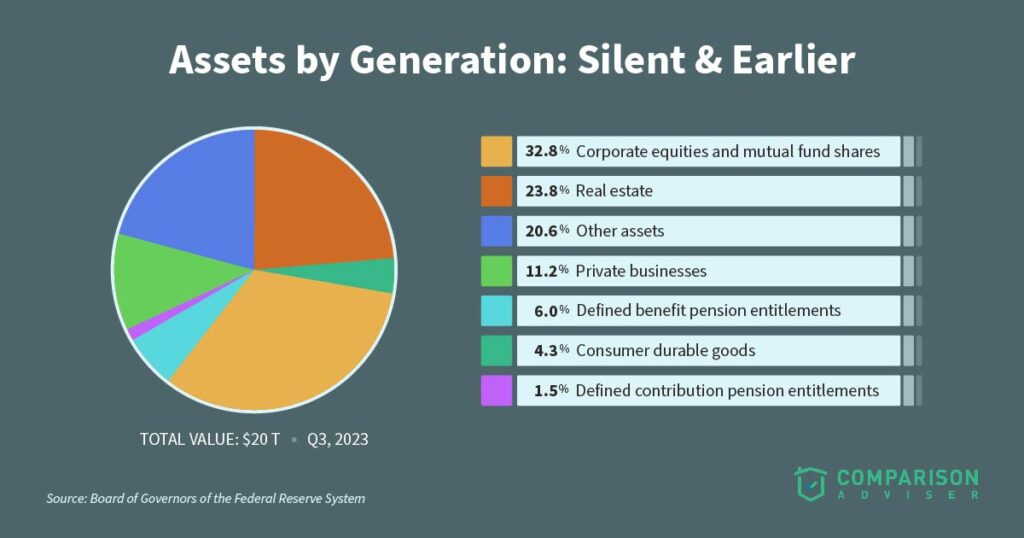

Silent and Earlier

The Silent Generation (people born between 1928 and 1945) and those born earlier represent a relatively small portion of the Great Wealth Transfer. These individuals bring approximately $20 trillion to bear currently, according to the Board of Governors of the Federal Reserve System.

Corporate equities and mutual fund shares equate to the largest wealth component of the Silent Generation, with 32.8% coming from this category. Significantly, an additional 23.8% derives from real estate holdings, which may refer to homes, commercial properties, or shares in real estate investment trusts (REITs).

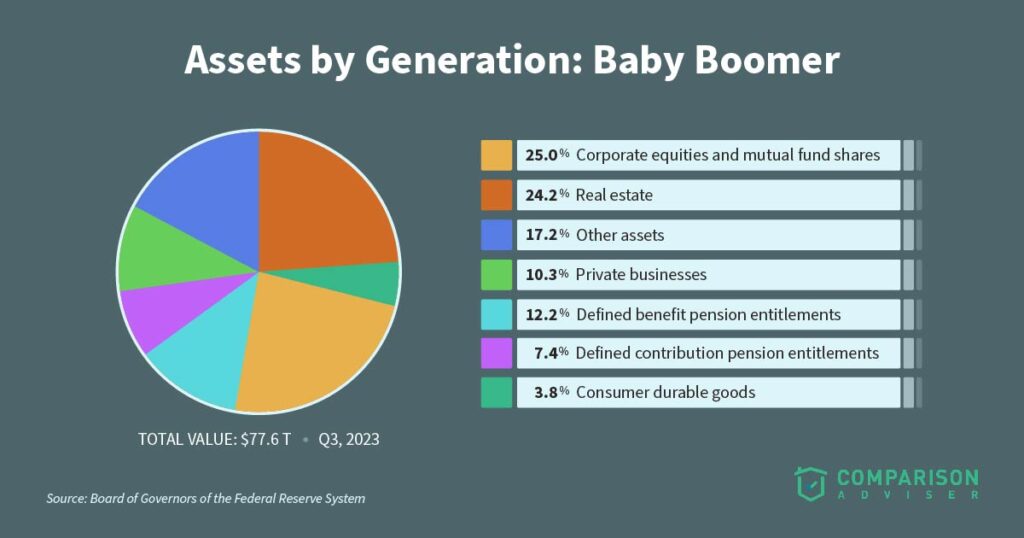

Baby Boomer

The most sizeable chunk of wealth, as highlighted, comes from the baby boomer generation (those born from 1946 to 1964). Much like the Silent Generation and prior, most of the assets from this category come from real estate and corporate equities, with 24.2% and 25.0%, respectively. The remaining portion primarily stems from private business and retirement plans, such as 401(k)s or IRAs.

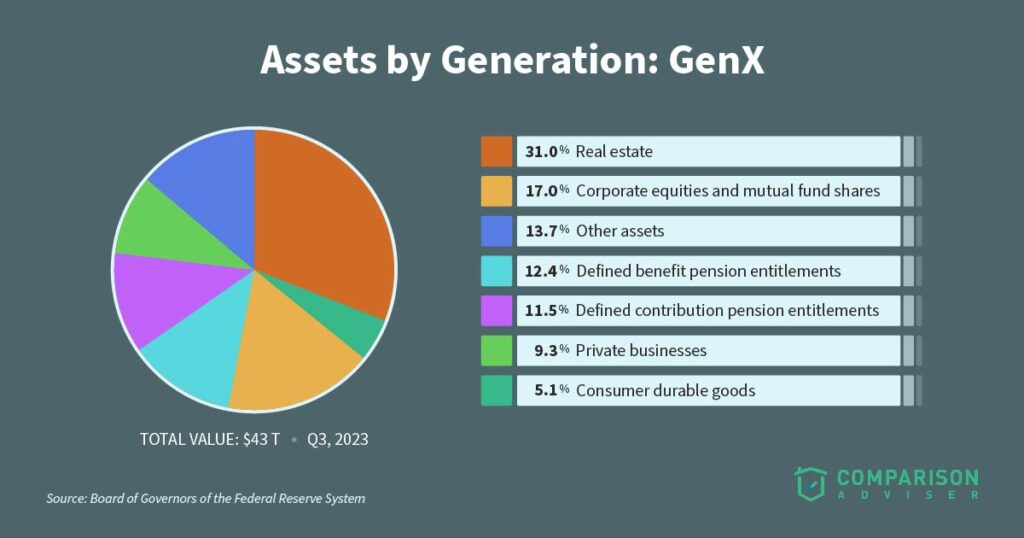

Gen X

Over $40 trillion of wealth is held by Gen X. And, over the next three decades, this number will substantially grow as assets from both the Silent Generation and baby boomers change hands.

Of note in the data above is that the younger a generation, the more of their wealth is held in real estate than any other type of asset. In terms of Gen X, this may be because many had the opportunity to buy during the Great Recession, giving them the chance to realize substantial returns on investment today due to skyrocketing property values.

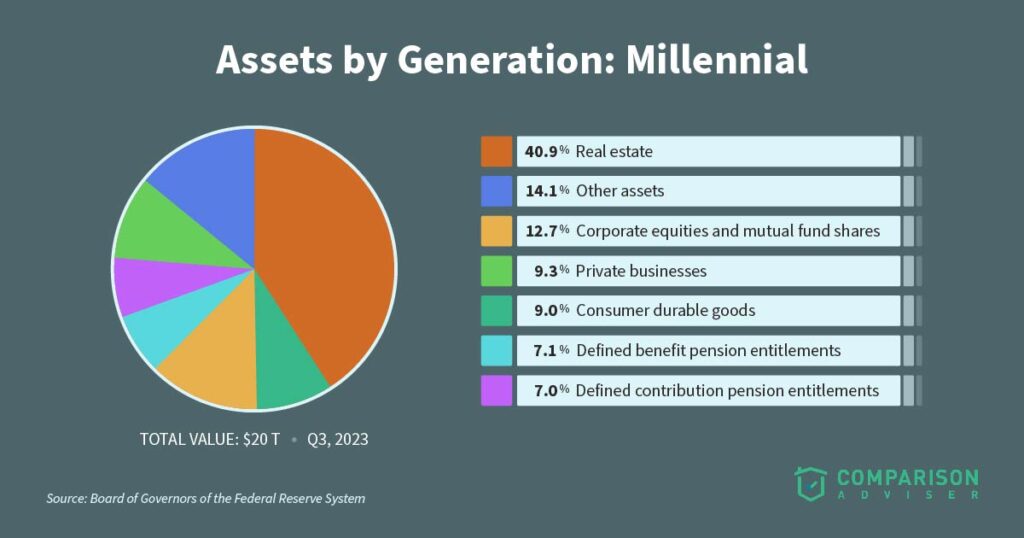

Millennial

In addition to Gen X, millennials (Gen Y) are another generation that is looking to gain from the Great Wealth Transfer. About 40% of this group’s wealth, a quite lopsided proportion, is held in real estate. And, compared to other generations, less wealth is made up of retirement plans. While it’s likely due to individuals still being relatively early in their careers, it may also signal millennials being unable to save and invest as much as their older counterparts.

Who Stands to Benefit the Most

The prospect of a gigantic generational wealth transfer is an exciting and promising thought for young generations; however, it can be misleading. On the surface, it seems like trillions will simply flow downstream equally to subsequent generations, leaving people with generous windfalls that can help them pay off debt, enhance their lifestyle, and perhaps even retire early. The reality, unfortunately, is that not everyone will get to benefit from this event over the next several decades.

It’s a known fact, based on the data above, that the Silent Generation and baby boomers hold about $97.6 trillion of the wealth in the United States; however, who gets that money once they pass isn’t simply decided by generation. Instead, it’s more likely for individuals with parents who are already in a healthy financial position beforehand to receive a significant inheritance. And in many cases, these are often educated individuals who have held strong positions during their careers. For instance, according to the Federal Reserve Board, families with a college degree have about “1.7 times the wealth of [one] without a parent with a college degree.”

The assets by generation data above also suggests that those whose parents have successfully planned and saved for retirement are more likely to benefit from the Great Wealth Transfer. Among the baby boomers, 19.6% of their wealth derives from retirement accounts and 25% comes from corporate equities and mutual funds. To acquire both, one must have saved and invested over several years. Unfortunately, more than half of boomers don’t have enough to comfortably retire and will rely on their Social Security benefits, according to Fox Business.

Kevin Quinn, President and Founding Attorney, Legacy Counsellors, P.C. and Founder of the My Family, My Wealth™ Program, shares that, while it’s obvious that children of the wealthy will inherit the most, “thoughtful, purposeful planning” enables heirs “to take advantage of opportunities that they may not have been able to enjoy without the inheritance.” For instance, this may include “paying off student loans, reducing or eliminating mortgages, education for the beneficiary or education for the beneficiary’s descendants, start up of a business, or simply being able to retire in comfort that would not otherwise be available.”

While affluent children will receive the most, those who carefully plan and manage their funds once they receive their windfall stand to benefit most. This is because, as Quinn mentions, impacts are felt not just by receiving money, but by what one ultimately does with it.

Wealth Transfer Obstacles

Transferring wealth from one generation to another takes careful planning and consideration from both the predecessor and the heir. Often, both parties may encounter significant challenges that can impact how much a beneficiary receives, cause family strife, or stress for the person who will eventually pass on their wealth.

Per Cheng, “Lack of communication and coordination” are two major obstacles people may face when the transfer of wealth occurs. More specifically, not communicating with family members beforehand about who gets what, who will be the executor, or any resources they may use can cause significant problems. Additionally, failing to coordinate or build a proper estate plan with the help of a financial advisor or attorney can spell trouble for one’s assets, leaving it up to a probate court administrator to decide who receives an inheritance.

An additional challenge for one who plans to pass on wealth is not accounting for costs that may occur upon retirement. Chief among those is healthcare, referring to both insurance and long-term care. According to the National Council on Aging, the monthly median cost for a private nursing home room is $9,034. Over several years, this amount can dramatically impact or deplete one’s assets, leaving them nothing to bequeath to subsequent generations.

On the other hand, beneficiaries may also face challenges. First, as of 2024, if an estate is worth over $13.61 million, the federal government imposes an estate tax of 18 to 40%. Moreover, when one does receive an inheritance, it can be easy to squander it without careful planning or assistance from a financial professional.

Why Financial Advice Is Important

With the Great Wealth Transfer underway and the many challenges facing families and their heirs, financial advice is a necessity now more than ever. The help of a professional is an invaluable tool that can help one plan for a future transfer of assets or assist heirs with handling a windfall.

Cheng, an experienced financial advisor, explains that a professional “can help clients understand the distinction between estate planning [and] wealth transfer.” The former “focuses on protecting your assets and creating a plan to deal with your assets after your death.” Meanwhile, the latter emphasizes creating a “successful estate plan because it incorporates family issues related to wealth, enabling [it] to accomplish exactly what you would like to happen.”

By having a plan in place, families can avoid mistakes and ensure a smooth transfer of funds. To illustrate the importance of planning, Andrew Bellak, a partner and wealth advisor at Perigon Wealth, shares a story regarding a divorcee in her 60s who is the daughter of a nearly 90-year-old wealthy woman:

The daughter did not have an extravagant lifestyle and her finances and long-term financial plan had been severely reduced by the divorce. They all had a healthy conversation about gifting prior to the mom passing away so that the divorcee daughter could enjoy a more comfortable quality of life sooner and take advantage of the possible tax law changing in 2026 to a lower Federal estate tax exemption threshold.

For younger individuals who receive an inheritance, it’s also paramount to have a financial advisor in your corner. An expert can help you determine how best to invest or manage your newfound funds to preserve them and grow them over time.

Additionally, Bellak points out that it’s important to seek “meaning and purpose” in your life after you “inherit a lot of money.” He adds, “Part-time work, volunteering, mentoring, spiritual communities, other communities, grand parenting, etc.” are all good examples of this. “I think the reverse of the Shining saying is true: All play and no work makes Johnny a dull boy,” says Bellak.

Bottom Line

The impending Great Wealth Transfer may be life-changing and exciting for some, but it will also bring on a series of challenges that families must face. Quinn points out that, in his experience, “many clients, even very wealthy and sophisticated clients, need guidance to organize their thoughts and identify the purpose behind the gifts they leave to their family.” He also adds that “families who take the time to identify common goals and common purposes,” as well as build “multi-generational relationships with key advisors” can “improve the experience of wealth transfer” and “reduce the stress and emotion” that’s part of it.

For both the wealthy and their heirs, seeking financial advice and planning ahead is essential. Even if the transfer is seemingly far off, it’s never a bad time to sit down with a professional to determine what it will look like and how it will work.

Methodology

The entirety of the wealth component and generational data in this study is from the Board of Governors of the Federal Reserve System. The data outlines the breakdown of assets and overall wealth from the Silent Generation or earlier, baby boomers, Gen X, and millennials.