MLB Player to CFP® Professional: Lessons from Matt Mieske

The former MLB player and current financial advisor shares his journey to a new career and insights on managing challenges in both money and life.

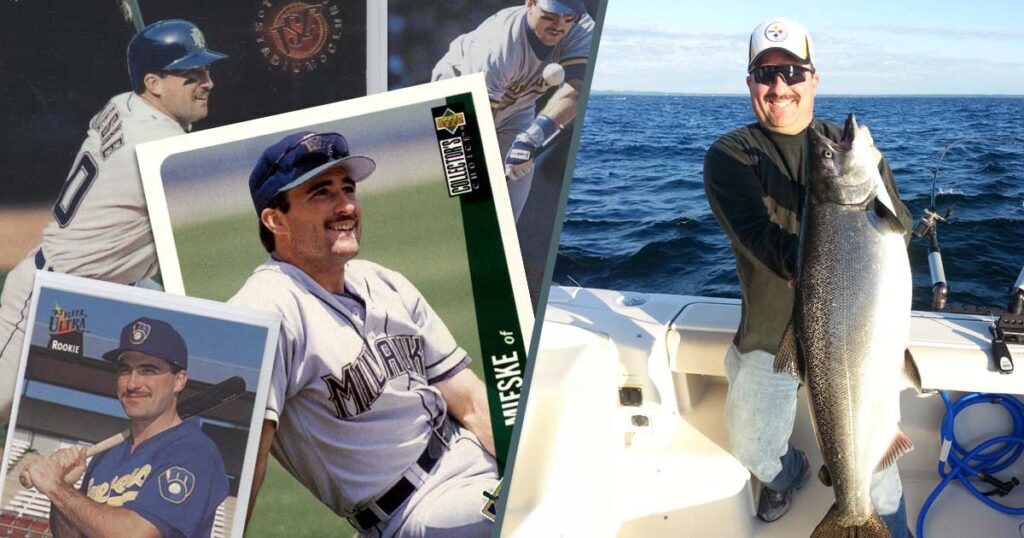

For a professional baseball player, not much can pressure you more than stepping up to the plate in a crowded venue. However, for Matt Mieske, a former Major League Baseball (MLB) right fielder and current Certified Financial Planner (CFP®) professional, transitioning from an athletic career to financial advising presented a new and unique challenge, but one he was well-prepared for. His journey offers valuable lessons that can help you learn how to succeed both financially and personally.

In the following sections, we explore Mieske’s leap from the baseball diamond to a career in financial advice. We’ll offer his insights on the unique financial challenges athletes face and the advice he would give them. Additionally, we’ll outline his perspective on the financial advisor industry and share his tips on hiring the right professional.

Key Takeaways

- Equipping yourself with a backup plan is crucial, even if you’re confident you’ll see success in your original career pursuit.

- Financial literacy is vital for young athletes and professionals alike to avoid mistakes and make the right decisions.

- Finding a trustworthy, qualified financial advisor is essential.

- It’s crucial for advisors to uphold the highest ethical standards to maintain a sense of trust between clients and firms.

Transition from Major League Baseball to Financial Advice

Athletes, like many aspiring professionals, prepare for several years for their careers. Unfortunately, this leaves little room for backup planning, especially if one is completely locked in mentally toward reaching their goals. In that way, anticipating and planning for what comes next can fall by the wayside and present a massive challenge.

Before Mieske’s 8-year career in the MLB, he received his bachelor’s degree in business administration and accounting. He says, “It gave me a good baseline of information and knowledge that I [could use] to go into a lot of different fields.” While he “didn’t really know” initially what he wanted to do with this education, it gave him the key background he needed for future opportunities.

Mieske notes that earning a college degree wasn’t necessarily the norm in the league when he was playing. “I’d say most athletes that play professionally don’t really focus a whole lot on the education side. It’s more of a steppingstone to get to where they want to go,” he says, adding that he “was the only one that had a degree on a couple of the teams [he] played on.”

When his playing career ended at age 32, Mieske knew he would continue working to secure a comfortable lifestyle for himself and his family. “I never felt like I was just going to play baseball and never have to work again. I mean, I did well, but at 32 that’s 30 years until you’re eligible for Social Security,” he remarks.

Today, he is a financial advisor at his firm, Mieske Financial Services, LLC in Freeland, Michigan, where he serves clients in his community, helping them gain control over their finances and plan for their future. “It’s a people business and I’ve always enjoyed getting to meet new people and help them and to take complicated things and break them down into more digestible, simple concepts to help people accomplish their goals and dreams,” says Mieske.

Mieske’s foresight and educational background allowed him to settle into a fulfilling career that would support his family long-term. His story underscores the importance of education and preparing to pivot when necessary. Whether you’re an athlete, entrepreneur, or other professional, having a vision for the future is critical. As Mieske’s journey illustrates, success sometimes means shifting to an entirely new path.

Unique Financial Challenges Athletes Face

While many face financial challenges, professional athletes must overcome several unique obstacles. Unpredictable career lengths, a lack of financial literacy, and societal pressure are all significant issues Mieske outlines as challenges he and others confront.

Although Mieske’s career lasted eight years, many athletes face much shorter stints that can end abruptly. He underlines that “the career-ending injury can happen at any time,” leaving players “in a lurch” without proper financial planning. Therefore, he emphasizes the value of having a backup plan or an education that allows for a smoother transition into the next phase of life.

Finding a trustworthy, qualified financial advisor is another concern athletes face. Mieske explains that, often, a player’s agent “becomes the first kind of trusted advisor” in their life, especially regarding finances. However, Mieske says that “athletes have no idea for the most part how to qualify [a professional]” if they’re seeking one on their own. This makes it all the more important for athletes to know how to properly vet financial professionals to receive sound and credible advice.

Additionally, athletes can deal with heightened pressure to live a lavish lifestyle by friends, family, and society. Those closest to you “can get kind of fascinated with the idea that, ‘I have a relative who’s playing professionally or I have a friend who’s playing professionally’ and that buys them a certain status and they don’t want to see that go away,” Mieske points out. Unfortunately, this can cause athletes to make poor financial decisions they wouldn’t otherwise make, such as buying expensive items or experiences to keep up a certain lifestyle, especially if there isn’t a professional to help them.

Despite the unique challenges athletes might need to overcome, financial literacy, long-term planning, and the help of a reputable professional can help overcome them. With the right guidance and preparation, athletes can navigate these obstacles and secure financial stability both during and after their careers.

Matt Mieske’s Financial Advice for the Next Generation

There are countless pieces of financial advice that young people can learn. For Mieske, however, the first that comes to mind is to “start early” by “investing at a young age.” Whether you’re an athlete or someone starting your first job, placing your earnings in a brokerage or retirement account can allow you to build wealth over a large chunk of your adult life.

Second, Mieske advocates the idea of “living within your means.” As an athlete or a high earner, this is imperative because it allows you more to save and invest. He adds that, as an athlete, “you go from making a lot of money when you’re under contract to any other job, which is not going to pay as much, you have to adjust your lifestyle accordingly. And that’s a hard thing to do for some.” Avoiding overextending enables your wealth to stretch farther and ensure a more comfortable lifestyle.

Another key point Mieske explains, which isn’t limited to only financial advice, is the importance of problem-solving skills:

Life to me is a series of problem-solving skills or problem-solving situations… it doesn’t matter who you are or what you do or where you live, life’s hard and it creates dilemmas in relationships and work…it’s a series of solving those problems that helps you grow and…achieve things and have success.

As an athlete, Mieske applied his problem-solving skills in the clubhouse and on the diamond. Since he left the league, he’s been able to use it by serving clients in his community, whether by establishing a comprehensive financial plan or managing a portfolio. If you’re a young person, the value of problem-solving and critical thinking will help propel you through your career and demanding situations, such as planning for retirement or navigating a marriage or business relationship.

Perspectives on the Financial Advice Industry

Trust is a core element of all healthy relationships, but when it comes to financial advice, it’s fundamental. As a client, you want to know that an advisor acts in your best interest above all else. Unfortunately, this isn’t always the case and, in Mieske’s experience in the industry, it can be all too prevalent for clients to be led astray by ill-informed or crooked professionals:

I can’t tell you how many times…in my career that someone has come into my office that I hadn’t previously worked with…and brought in statements for accounts that they had set up previously and it gives you a window into what their experience has been like in their life and sometimes you see things that were done or that they were encouraged to do.”

Even today, with the fiduciary duty being the standard for registered investment advisor (RIA) firms, bad actors exist and can create a sense of distrust between the client and a professional, especially when conflicts of interest arise. “When you see it, it’s disheartening because it hurts our whole industry” Mieske shares. He adds that baseball experienced similar issues during the steroid era in which he played, “How do you know which players are and which players aren’t cheating? And so, it kind of taints any achievement during that period.” In this way, advisors must always uphold the highest ethical standards to maintain the integrity of the entire industry.